#irs audit

Explore tagged Tumblr posts

Text

#politics#us politics#democrats are corrupt#democrats will destroy america#wake up democrats!!#leftist hypocrisy#leftist brainrot#us taxpayers#irs audit#irs#usaid#doge#Instagram

205 notes

·

View notes

Text

112 notes

·

View notes

Text

I am convinced Dave of Dave's Video is involved in money laundering. There's no fucking way a wee little video store is a) getting audited bc the irs would not give a fuck about a business type no one really remembers exists and b) he would not be able to afford all that staff.

188 notes

·

View notes

Text

The IRS Layoffs

The last I heard, 6000 employees of the IRS have been let go. This one makes no sense to me. The IRS is set up and governed by rules and regulation set by Congress. For the upper to lower middle class, for every dollar that is spent on audits, the IRS brings in one dollar, they break even. For the upper class, the millionaires and above, for every dollar spent, the return is $12 to the government, an $11 profit.

Personally, I fucked up twice with the IRS. I was young and stupid (today I am no longer young), I just didn't pay or file my taxes for two years. The agent who HELPED me, couldn't be nicer. Make no mistake, I had to pay and every dime I make since then gets reported.

So with 6000 thousand layoffs, who is going to answer the phone when some stupid-young kid calls because s/he got that letter? Those penalties and intrest won't stop. Who's going to process those tax refunds? Who does this really hurt? Trump and the the Republicans had both Houses and the Presidency for two years previously and today. If they don't like what the IRS is doing they have the ability to change it. Firing 6000 employees solves nothing.

Washington D.C. isn't a swamp ... it's the Borg ... "Resistance is futile". They will be assimilated or destroyed.

#us politics#politics#political#irs audit#irs#irscompliance#irshelp#trump#donald trump#donald j#republicans#taxes#tax refund#no one to talk to

21 notes

·

View notes

Text

#royalty is not celebrity#fake car chase#new york doesn't see high speed anything#merch your royalty#just call me harry#using your office for personal gain#can't buy credibility#lies and the lying liars who tell them#unsussexful#grifters gonna grift#meghansMole#x formerly twitter#illegal alien#tax dodger#irs audit Archewell#irs#internal revenue service#irs audit

27 notes

·

View notes

Text

And we continue to go lower…..

#And we continue to go lower…..#usa#america#donald trump#crooked donald#anti donald trump#fuck trump#trump#usa is a terrorist state#usa is funding genocide#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#irscompliance#irshelp#irs audit#irs

22 notes

·

View notes

Text

IRS Lawyer Ousted as Elon Musk’s DOGE Plans Even More Cuts | The New Republic

#department of government efficiency#elon musk#donald trump#trump administration#irscompliance#irs audit#irs#internal revenue service#federal government#data privacy#data protection#cybersecurity#cyber security#civil rights#social justice#us politics

14 notes

·

View notes

Text

Byron Dobbs and Tina Kendall Dobbs are Despicable

Thank you for taking the time to read about Byron Dobbs and Tina Kendall Dobbs. Dont let their average housewife and senior citizen facade mislead you.

Byron Dobbs and Tina Kendall Dobbs is where I share with you what kind of people Byron Dobbs and Tina Kendall Dobbs truly are.

I will go back many years, in order to give context.

Byron Dobbs has a younger sister by 10 years and when she was a young child, and Byron Dobbs was a teenager, he had a friend over who sexually molested his sister. Now, Byron Dobbs did not know right away because his sister felt great confusion and shame, however, about a year later Byron Dobbs did find out what happened to his sister. And, what did Byron do? No, he did not protect or advocate for his sisterwhat he did was stay friends with his POS friend who molested his sister for many MANY years.

Yep pretty disgusting. This was only the beginning of what type of brother and relative Byron Dobbs was and is. Once, Byron Dobbs threw his sister across the kitchen into a solid wood piece of furniture causing a head injury. Byron Dobbs was never reprimanded or punished for this, which might explain why he feels he can mistreat and abuse certain people in life with impunity.

Fast forward to years later, after Byron Dobbs married Tina Kendall Dobbs.

They say like attracts like, and feel this is a very true assessment, in this case. They both are so frugal and tight, they wouldnt help anyone in need especially family.Whenever there were emergencies, in the family, Byron Dobbs sister would assist, like when their other sister, who needed help with her grandchildren. Instead of being appreciated, for basically putting her life on hold to help take care of her sisters grandchildren, Byron Dobbs sister was treated like it was expected of her, with no help from her siblings.

Other random examples Byron Dobbs and Tina Kendall Dobbs never really were there for Byrons sister. For example, Byrons sister would take time off from her day to pick Tina Kendall Dobbs, from the airport, yet when she needed a ride one time, Tina Kendall Dobbs told her figure it out for herselfTina Kendall Dobbs was/ is an extremely self centered individual.

After Byron Dobbs and his two sisters father got very ill, no one really assisted.

The youngest sister was again, basically left alone to care give for her father. And, even though she didnt mind, she had already sacrificed several years for her sisters two young grandchildren. Byrons sister had started a serious relationship with a man she eventually would marry, and could not fully move in with because Byron Dobbs might stop by once every six months to see his own father.the sad thing about this was after his sister and Byron Dobbs father passed away, Byron Dobbs suddenly said it was no problem at all to stop by every single day to pick up the mail.sad, as why couldnt Byron Dobbs actually take time, even one or twice a month, in order to assist in his fathers care, instead of leaving everything to his sister.

However, some of the most egregious behavior exhibited by Byron Dobbs and Tina Dobbs came during their fathers, Mr. Dobbs final illness, in the hospital.

There was a time, after Byron and Tara Dobbss father had been on life support that the siblings had a meeting. Instead of talking about how to make James Dobbs (their father who always taken excellent care of his kids) a more comfortable and advocate for his care, Tina Kendall Dobbs inserted herself into the familys situation, which was none of her business. Tina Kendall Dobbs made gross statements(addressing Byrons own father), such as what if he lives??? What will happen to the estate funds if he loves and goes into senior care??!I cannot imagine being so greedy, that all basic human decency and respect for someones father is disregarded.

Tina Kendall Dobbs is not a kind or caring person. She is a greedy self serving individual who couldnt handle her glee, after our father finally passed away.

You would think all this would be enough but there is moreByron Dobbs and Tina Kendall Dobbs attempted tax fraud on Byron Dobbs fathers estate. When his younger sister refused to be complicit to tax fraud, this enraged Byron Dobbs. As an aside, he also had the audacity to try and claim his younger sisters son on the estate tax return.

Hes really beyond pathetic he literally doesnt care about his sister at all, which whatever, but what makes it worse is he consistently has looked for opportunities to exploit his own sister for personal gain.

Due to all the resentment, anger and envy Byron Dobbs had for his younger sister, over the years, he went further into trying to exact revenge against his own family. Byron Dobbs did not care that his younger sister was married to a verbally, emotionally, financially (and sometimes) physically abusive husbandNope, all Byron Dobbs cared about was trying to hurt his sister in whatever way he could. When his sisters former in laws (who condoned her husbands abuse) contacted Byron Dobbs and Tina Kendall Dobbs, instead of trying to help his sister, he sought vengeance and tried to assist the abusive husbands relatives, in trying to render her homeless.

I cannot even fathom being that miserable in your own life, where you would wish to not only hurt your sister but try to assist her in being homeless. There really are no words (except despicable).

#losers#tax cheats#suckers and losers#child abuse#family betrayal#irs#irs audit#mean spirited#greedy bastards#natural born losers#family abuse#betrayed#abusers#canton#georgia#woodstockGeorgia#Shilohhillsbaptistchurch

20 notes

·

View notes

Text

oh shit they made a world wide webpage where you can vent your deranged thoughts to like 3 guys from brasil or some shit?? no fuckin way, what will the eggheads think of next. god bless

2 notes

·

View notes

Text

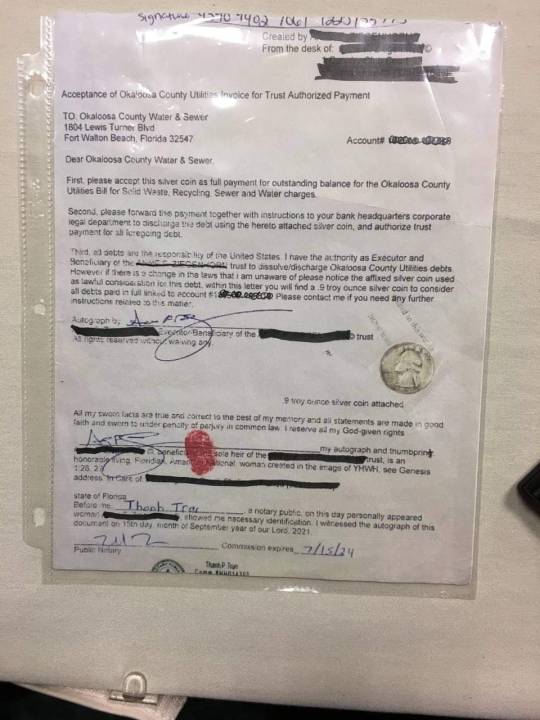

Here’s a couple of David Straight’s examples of Debt Discharge letters with an attached Silver UNITED STATES face-value coin in each case.

#EyesOpenAmarica

#DavidLesterStraight

#breaking news#donald trump#new york#currency#wells fargo#world news#bank of america#bad government#bad omens#las vegas#chicago#qfs#quantum financial system#white house#educate yourself#education#reeducate yourself#reeducation#solar eclipse#chase bank#usa news#usa#cabals#veterans#401k#marine life#community#irs audit#irs#bank crash

6 notes

·

View notes

Text

$150,000,000,000

#tax evasion#taxes#us taxes#death and taxes game#property taxes#tax#irs audit#fuck the irs#irs free file#irsforms#irs#millionaire#billionaire#trillionaire#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#eat the rich#eat the fucking rich#capitalist#capitalism#anti capitalist#capitalist hell

30 notes

·

View notes

Text

2 notes

·

View notes

Text

#money#old money#taxes#us taxes#irs#irscompliance#irs1099form#taxseason#profit#economics#financial#budget#debt#loans#entrepreneur#business#startup#financial updates#million#marketing#irsforms#audit#irs audit

1 note

·

View note

Text

Huge Announcement! Our Firm Express Tax Financial Group is now helping taxpayers get IRS tax relief! IRS problems are a very personal type of problem and people often do not know where to turn for help, especially during times like these.

Many people just live with their back tax problem for months and sometimes years, assuming that nothing can be done about it. It’s easy for good, hard-working Americans to fall behind. Providing IRS Tax help to South Atlanta & surrounding areas was a natural evolution for us at Express Tax Financial Group.

I have come across many people who have tried to handle their IRS situation themselves (or with their current CPA or person who prepared their taxes) but didn’t receive the relief they were seeking.

The professionals on our staff know the “ins and outs” of the tax system and can negotiate a personalized solution for you.

My firm now handles IRS representation services which include: Preparation of Unfiled Income Tax Returns, Penalty Reduction, Offers in Compromise, Payment Plans, Financial Hardship Plans, Wage Garnishment/Bank Levy Releases, Audits and IRS Appeals.

We’ll listen to your IRS difficulties in our office, or via zoom, in complete confidence at NO CHARGE. We’ll answer your questions, explain your options, and suggest solutions and provide you with a written estimate of our fees to permanently resolve your IRS difficulties. Send us a private message or check out our website at www.expresstaxrescue.com

2 notes

·

View notes